Kansas Tax Form K-40 Svr . learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. must be a kansas resident the entire tax year; This allows a property tax. Age 65 or older for the entire tax year; Home owner during the tax year;

from www.formsbank.com

learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. must be a kansas resident the entire tax year; Home owner during the tax year; Age 65 or older for the entire tax year; This allows a property tax.

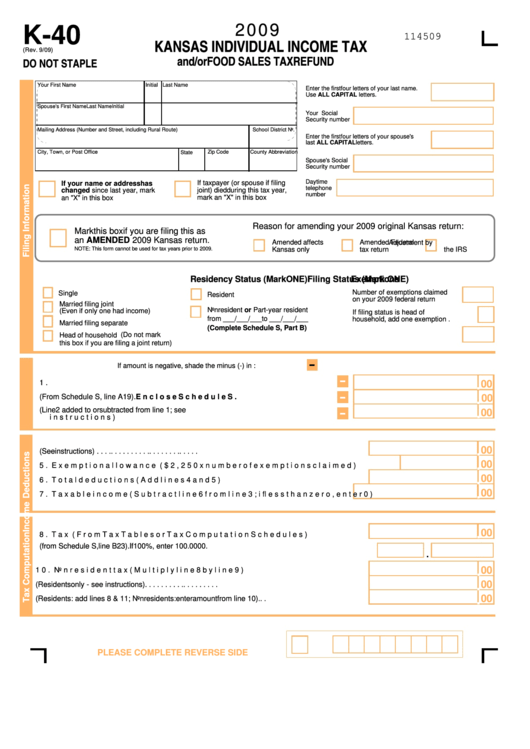

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

Kansas Tax Form K-40 Svr learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Age 65 or older for the entire tax year; Home owner during the tax year; must be a kansas resident the entire tax year; This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas.

From www.dochub.com

Kansas tax form k 120s 2018 Fill out & sign online DocHub Kansas Tax Form K-40 Svr This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Home owner during the tax year; Age 65 or older for the entire tax year; must be a kansas resident the entire tax year; Kansas Tax Form K-40 Svr.

From fill.io

Fill Free fillable Kansas Department of Revenue PDF forms Kansas Tax Form K-40 Svr Home owner during the tax year; Age 65 or older for the entire tax year; must be a kansas resident the entire tax year; This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Kansas Tax Form K-40 Svr.

From www.formsbank.com

Form K120v 2010 Kansas Corporate Tax Voucher printable pdf Kansas Tax Form K-40 Svr learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. must be a kansas resident the entire tax year; This allows a property tax. Home owner during the tax year; Age 65 or older for the entire tax year; Kansas Tax Form K-40 Svr.

From www.formsbank.com

Form K40es 2003 Kansas Individual Estimated Tax Voucher Kansas Tax Form K-40 Svr Home owner during the tax year; Age 65 or older for the entire tax year; must be a kansas resident the entire tax year; learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. This allows a property tax. Kansas Tax Form K-40 Svr.

From www.dochub.com

K40 tax form Fill out & sign online DocHub Kansas Tax Form K-40 Svr must be a kansas resident the entire tax year; Home owner during the tax year; This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Age 65 or older for the entire tax year; Kansas Tax Form K-40 Svr.

From www.formsbank.com

Fillable Form K40v Kansas Individual Tax Payment Voucher Kansas Tax Form K-40 Svr must be a kansas resident the entire tax year; Age 65 or older for the entire tax year; Home owner during the tax year; This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Kansas Tax Form K-40 Svr.

From studylib.net

Current K40 tax form Kansas Department of Revenue Kansas Tax Form K-40 Svr Age 65 or older for the entire tax year; learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. must be a kansas resident the entire tax year; Home owner during the tax year; This allows a property tax. Kansas Tax Form K-40 Svr.

From www.formsbank.com

Fillable Form K40 Pt Kansas Property Tax Relief Claim 2012 Kansas Tax Form K-40 Svr must be a kansas resident the entire tax year; This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Home owner during the tax year; Age 65 or older for the entire tax year; Kansas Tax Form K-40 Svr.

From www.formsbank.com

Form K41 Kansas Fiduciary Tax 2000 printable pdf download Kansas Tax Form K-40 Svr learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Age 65 or older for the entire tax year; Home owner during the tax year; must be a kansas resident the entire tax year; This allows a property tax. Kansas Tax Form K-40 Svr.

From www.pdffiller.com

2015 Form KS DoR K120 Fill Online, Printable, Fillable, Blank pdfFiller Kansas Tax Form K-40 Svr This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. must be a kansas resident the entire tax year; Age 65 or older for the entire tax year; Home owner during the tax year; Kansas Tax Form K-40 Svr.

From printableformsfree.com

Free Printable Kansas Tax Forms Printable Forms Free Online Kansas Tax Form K-40 Svr learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Home owner during the tax year; Age 65 or older for the entire tax year; must be a kansas resident the entire tax year; This allows a property tax. Kansas Tax Form K-40 Svr.

From www.uslegalforms.com

KS DoR K40 2014 Fill out Tax Template Online US Legal Forms Kansas Tax Form K-40 Svr Home owner during the tax year; must be a kansas resident the entire tax year; Age 65 or older for the entire tax year; This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Kansas Tax Form K-40 Svr.

From www.formsbank.com

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund Kansas Tax Form K-40 Svr Home owner during the tax year; learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. This allows a property tax. Age 65 or older for the entire tax year; must be a kansas resident the entire tax year; Kansas Tax Form K-40 Svr.

From www.pinterest.com

Need a K40h Form Kansas Homestead Claim? Here's a free template Kansas Tax Form K-40 Svr Home owner during the tax year; This allows a property tax. Age 65 or older for the entire tax year; must be a kansas resident the entire tax year; learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Kansas Tax Form K-40 Svr.

From www.formsbank.com

Fillable Form K40 Kansas Individual Tax 2013 printable pdf Kansas Tax Form K-40 Svr Home owner during the tax year; learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. This allows a property tax. must be a kansas resident the entire tax year; Age 65 or older for the entire tax year; Kansas Tax Form K-40 Svr.

From www.formsbank.com

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund Kansas Tax Form K-40 Svr Age 65 or older for the entire tax year; This allows a property tax. Home owner during the tax year; learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. must be a kansas resident the entire tax year; Kansas Tax Form K-40 Svr.

From www.formsbank.com

Fillable Form K120 Kansas Corporation Tax 2012 printable Kansas Tax Form K-40 Svr Home owner during the tax year; must be a kansas resident the entire tax year; Age 65 or older for the entire tax year; This allows a property tax. learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Kansas Tax Form K-40 Svr.

From www.snappii.com

Kansas K4 App Kansas Tax Form K-40 Svr must be a kansas resident the entire tax year; This allows a property tax. Age 65 or older for the entire tax year; Home owner during the tax year; learn how to apply for a safesr refund if you are a senior citizen with low income and pay property taxes in kansas. Kansas Tax Form K-40 Svr.